Nigeria has taken a bold step to strengthen its local shea industry with the government’s newly approved six-month ban on the export of raw shea nuts. This decision, announced by Vice President Kashim Shettima, aims to restrict informal trade, shore up domestic processing, and position Nigeria as a major player in the global shea value chain.

The temporary ban, effective immediately and subject to review after expiration, is part of a larger drive to build an industry capable of generating an estimated $300 million in annual revenue over the short term. The initiative’s main focus is to encourage value addition through local processing rather than exporting raw materials for minimal returns.

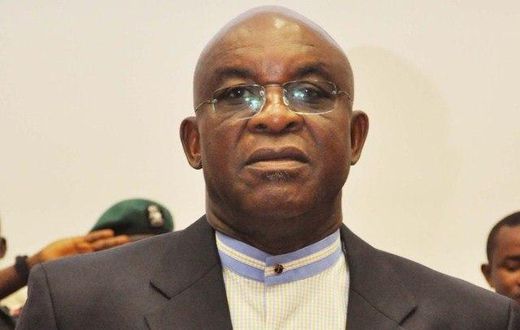

Speaking to a gathering of stakeholders at the Presidential Villa in Abuja, Vice President Shettima emphasized that the directive is not meant to stifle trade, but rather to foster growth within Nigeria’s borders. He reportedly stated, “This is not an anti-trade policy but a pro-value addition policy designed to secure raw materials for our processing factories and enable industries to operate at full capacity. This will help boost rural incomes and create jobs.”

Shettima reiterated that the ultimate goal is to transform Nigeria from an exporter of raw shea nuts to a dominant supplier of refined shea butter, shea oil, and related products worldwide. “This move is not just about industrialization, but about rural transformation, the empowerment of women, and expanding Nigeria’s reach in international trade,” he said.

As of now, Nigeria contributes close to 40% of the world’s shea nut production but reportedly earns less than 1% of the global shea market, which is estimated at approximately $6.5 billion, according to officials. “This situation is unacceptable,” Shettima said, highlighting the need for a robust value chain that could see earnings climb tenfold by 2027.

He underscored the collaborative nature of the policy, explaining that the decision had input from both state and federal governments and is designed to spark an economic transformation. Shettima also referenced global partnerships, noting that discussions are already underway with Brazil to open their market to Nigerian shea butter and oil within the next three months, according to official briefings.

A key feature of the policy is its direct support for women, especially those in rural communities. Shea picking and processing are industries dominated by women in Nigeria, and Shettima highlighted that policies protecting the sector also defend the livelihoods and dignity of millions of Nigerian women. “We are opening new opportunities. The work we do today will bear fruit for decades, uplifting women, strengthening our economy, and reinforcing Nigeria’s place in global trade,” he asserted.

Dr. Abubakar Kyari, Minister of Agriculture and Food Security, further explained the rationale behind the export ban. He cited Nigeria’s status as the world’s largest producer of shea nuts—reportedly around 350,000 metric tonnes annually across 30 states, with the potential to reach nearly 900,000 metric tonnes in the future. Despite this, Nigeria holds less than 1% of the multi-billion dollar global market, according to recent government data.

A rapid assessment of Nigeria’s shea value chain, conducted by the Presidential Fertilizer and Shea Coordinating Unit (PFSCU) in partnership with government ministries, found that informal cross-border trade drains over 90,000 metric tonnes of raw shea from the country each year. Surprisingly, even as domestic processors struggle at just 35 to 50% operating capacity—with overall installed capacity standing at 160,000 metric tonnes—the bulk of the raw material exits through unregulated channels.

Minister Kyari pointed out that neighbouring countries such as Ghana, Burkina Faso, Mali, and Togo have enacted similar export restrictions to safeguard and develop their respective shea industries. In contrast, Nigeria has become, according to his remarks, a “hotspot for opportunistic and unregulated buying.” This exposes the nation’s farmers and processors to unfair competition and loss of revenue.

Industry experts and economic analysts in Lagos and Abuja, as well as development agencies, have long advocated for strategic interventions to help Nigeria capture more value locally. According to Professor Chinedu Eze of the University of Ibadan, “Developing value-added processing not only creates jobs but allows Nigerian enterprises to claim a fairer share of the multi-billion-dollar global market. The ban is a strong signal that Nigeria is ready to end the pattern of exporting raw commodities with minimal return.”

According to government projections, the temporary ban could enable Nigeria to earn more than $300 million annually in the near term and could help secure a greater portion of a global shea market expected to reach $9 billion by 2030. “Shea is a commodity where we hold both comparative and absolute advantages,” Kyari noted, citing over five million hectares of wild-growing trees across the country.

The minister also referenced Nigeria’s “Zero Oil Plan”, which identifies shea as a strategic non-oil export capable of diversifying the country’s revenue streams. As international markets grow, the country is positioned to become not just a supplier of raw nuts but a hub for high-quality processed shea products, from cosmetics to food ingredients.

The social impact cannot be overstated. With around 90% of the shea workforce comprised of women—many of whom come from farming communities across northern and central Nigeria—the ban is expected to increase job opportunities, boost rural incomes, and support broader national development goals.

Minister Kyari emphasized that the government’s approach aligns with the administration’s focus on women’s empowerment and pledges to uplift rural populations and stimulate economic growth. “If we do nothing, Nigeria risks being reduced to a raw depot for opportunistic and illicit buyers, effectively undermining our processors and forfeiting billions in potential export revenues,” Kyari reportedly said.

Findings from the PFSCU’s rapid assessment, which engaged more than 2,000 pickers and 65 processors, highlighted the urgent need for government action. With informal exports draining as much as 90,000 metric tonnes annually, officials claimed that decisive intervention was necessary to protect the sector and ensure Nigeria’s long-term interests.

However, industry insiders note that enforcement remains a challenge. Informal border crossings, evolving smuggling methods, and lack of capacity in regulatory agencies could complicate quick results. Some local traders have voiced concerns about the possible impact on livelihoods in the short run, while others are optimistic about the job-creating potential of expanded local processing. According to Abuja-based economist Bola Oni, “The true measure of success will be the government’s ability to implement and enforce the ban effectively, invest in value chain infrastructure, and ensure inclusivity for affected stakeholders.”

On a regional scale, Nigeria’s move aligns with trends across West Africa. As more nations seek to boost local industries and retain the economic value of natural resources, questions are being raised about the future of commodity exports and regional trade agreements in ECOWAS and beyond. Some experts warn that countries may need to carefully balance protectionist measures with commitments to open trade and regional economic integration.

Globally, the demand for shea products, especially in cosmetics and food manufacturing, remains strong. If Nigeria succeeds in developing a vibrant domestic industry, the ripple effect could be significant—not only for the economy but also for millions of women and rural families whose livelihoods depend on this ancient West African crop.

The government has promised to work closely with industry groups, state governments, and community organizations to ensure a smooth transition, reduce losses, and lay the foundation for a more competitive shea industry. Advocacy groups encourage transparency and stakeholder input to make the policy’s benefits widespread and sustainable.

Will the temporary ban bring the transformation Nigeria’s shea industry so badly needs, or will it bring unintended challenges for rural communities? What’s your view on this landmark policy? Drop your comment below and let us know how this decision will affect your business or community.

For support, reach out at support@nowahalazone.com.

Stay in the loop—follow us on Facebook, X (Twitter), and Instagram for the latest updates and conversations around agriculture, business, and more!