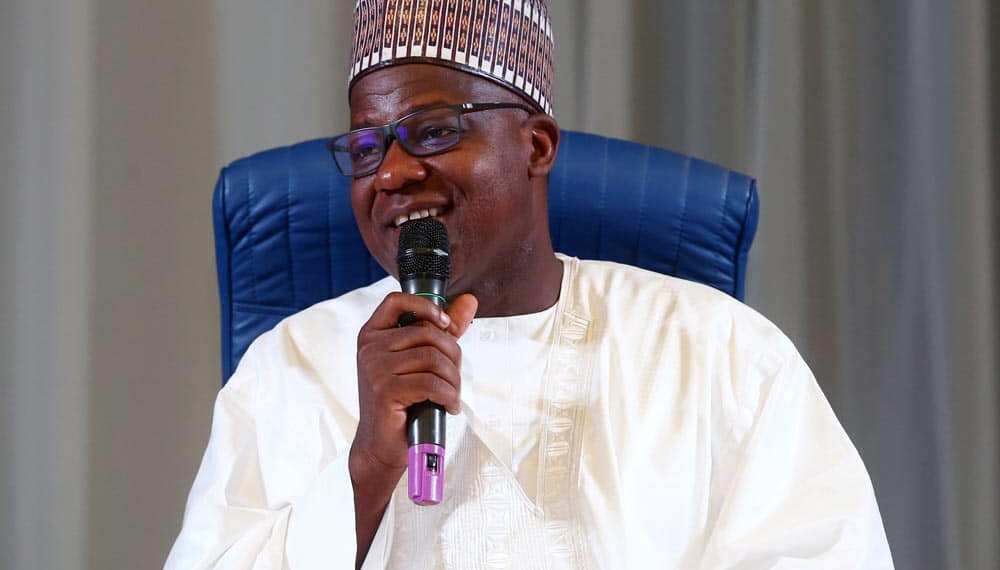

Sweeping changes are reshaping Nigeria’s tax landscape as the federal government, under President Bola Tinubu, introduces reforms that make tax compliance an integral part of everyday financial life. The former Speaker of the House of Representatives, Yakubu Dogara, emphasized the gravity of these reforms during his keynote at the inaugural Distinguished Parliamentarian Lecture in Abuja. Speaking as chair of the National Constitutional Governance Council (NCGC), Dogara outlined new legal requirements and the wider implications for Nigerian individuals and businesses.

The session, themed “Navigating Tax Reforms in Nigeria: Insights on President Bola Tinubu’s Policies,” drew government figures, policy experts, and business leaders eager to unpack the comprehensive tax overhaul signed into law in June 2025—reforms that dogara described as unprecedented in Nigeria’s modern history.

Understanding the New Tax Laws

At the core of the new tax regime are four principal acts:

- Nigeria Tax Administration Act (NTAA)

- Nigeria Tax Act (NTA)

- Nigeria Revenue Service Act (NRSA)

- Joint Revenue Board Act (JRBA)

These acts replace 16 previously existing statutes, offering a streamlined and modernized structure for tax collection, compliance, and revenue sharing between Nigeria’s federal and state governments.

Mandatory Tax Identification Number for Banking

One of the biggest shifts for Nigerians is the legal obligation to obtain a Tax Identification Number (Tax ID) before opening or maintaining a bank account. Quoting Section 4 of the NTAA, Dogara explained that any “taxable person”—defined broadly as any individual or company engaged in trade, business, or other activities that generate income—is affected.

“From now on, it is the law that every taxable person, including companies and other legal entities, must register with the tax authority and secure a Tax ID before they can access regular banking services,” Dogara said during his remarks. He clarified that this requirement does not apply to those who do not earn income or otherwise qualify as non-taxable under the law.

The obligation applies to both existing and new bank accounts, with banks and other financial institutions mandated to verify Tax IDs during account opening or continued operation. This move is designed to close loopholes that have allowed income-earners and corporations to sidestep tax obligations in the past.

Goals and Expected Impact of the Reforms

Dogara highlighted several key objectives behind the reforms:

- Protecting low-income earners: By modernizing collection and focusing enforcement, the system aims to shelter the poorest from undue burdens.

- Empowering business and investment: Clearer rules, better enforcement, and digital infrastructure are intended to reduce uncertainty and support entrepreneurs.

- Expanding the tax net: More robust compliance measures, including linking banking to tax registration, are set to widen the number of contributors, improving both fairness and government revenues.

- Fostering transparency: With tax IDs tied to financial accounts, authorities can better track economic activity, reduce evasion, and deliver more accountable governance.

Dogara asserted that while many Nigerians might initially view the tax ID requirement as an inconvenience, its long-term benefits—such as stronger public services, fairer competition among businesses, and improved economic credibility—will outweigh any short-term challenges.

Aligning with International Standards

Nigeria’s approach now mirrors practices in countries across Africa and worldwide, where banks and financial institutions play an active role in helping tax authorities ensure compliance. Dogara noted this marks a significant leap toward modernizing the country’s financial and regulatory environment, positioning Nigeria as a more attractive destination for investment within Africa and globally.

He referenced the 2025 reforms as “one of the boldest economic policy shifts” under the Tinubu administration, comparing it to other significant changes like the removal of the fuel subsidy and the unification of the naira’s exchange rate.

Recent Developments and Official Responses

The full texts of these tax laws are now publicly available, having been published in Nigeria’s official gazette. Taiwo Oyedele, who chairs the Presidential Committee on Fiscal Policy and Tax Reforms, has publicly confirmed the gazetting and provided ongoing clarification for businesses and individuals via his social media (see Oyedele’s recent thread on X).

Breaking Down the Four Main Laws

- Nigeria Tax Act (NTA): Consolidates previous income tax laws, extends the tax base to cover digital services and foreign exchange gains, and introduces a minimum effective tax rate for large firms.

- Nigeria Tax Administration Act (NTAA): Modernizes tax assessment, ensures digital record-keeping, streamlines dispute resolution, and mandates Tax IDs for taxable transactions and banking.

- Nigeria Revenue Service Act (NRSA): Establishes a central Nigeria Revenue Service by replacing the Federal Inland Revenue Service (FIRS), hoping to improve efficiency and cut duplication.

- Joint Revenue Board Act (JRBA): Brings greater harmony and coordination between federal and state tax authorities, clarifying how revenue is split and managed.

Comparisons & Regional Context

Nigeria’s new system increasingly resembles tax frameworks in Ghana, South Africa, and other leading African economies, where electronic compliance and integrated identification numbers are essential to banking and business. Regional analysts see these developments as helping West Africa minimize illicit financial flows and tax evasion, ultimately fueling faster development and regional trade.

Citizen Perspectives and Potential Hurdles

Despite the intended benefits, there’s awareness that implementation may not be seamless from the outset. Many Nigerians worry about bureaucratic delays, gaps in awareness, or challenges for the unbanked. Dogara and fiscal experts stress the importance of:

- Public education campaigns

- Simple registration processes—especially online

- Accessible tax service centers, including in rural or low-income areas

- Continued dialogue between government, banks, businesses, and civil society

Reactions from local business owners have been mixed. Some welcome the streamlined rules, hoping they will create a fairer playing field, while others express anxiety over additional paperwork and possible bottlenecks.

Editorial Analysis: What Does This Mean for Everyday Nigerians?

For the average Nigerian—whether salary earner, self-employed artisan, or SME owner—the reforms will demand closer attention to tax obligations. Banks will no longer be able to shield customers without verified Tax IDs, and government authorities will have new tools to track financial activity linked to income.

While sharper tax enforcement will help fund infrastructure and public services, the government’s ability to avoid overburdening the poor—or losing compliance due to administrative roadblocks—will determine the reforms’ local impact. Observers suggest that successful rollout and sustained communication will be key.

Next Steps and Outlook

The Tinubu administration urges Nigerians to embrace these measures, promising that with improved tax compliance, the government can deliver better health, education, infrastructure, and security. It remains to be seen how quickly banks, financial institutions, and tax offices can fully integrate the system and address inevitable challenges.

Stakeholders across the Nigerian economy will be watching closely—both for positive changes and necessary adjustments—to ensure the new tax system is fair, simple, and serves the country’s development goals.

What’s your take on these far-reaching tax reforms? Will the new rules make Nigeria’s economy stronger, or do you foresee obstacles for everyday people? Share your thoughts and experiences with us.

Do you have a news tip, a business concern, or a story to share about Nigeria’s new tax system? We want to hear your voice! Email us at story@nowahalazone.com for story features or sales.

If you have a question or need help, our team is here for you: support@nowahalazone.com

Follow us on Facebook, X (Twitter), and Instagram for the latest updates and in-depth stories affecting your pocket.

Your experiences and insights matter—drop a comment, engage in the conversation, and help us bring your stories to a wider West African and global audience.