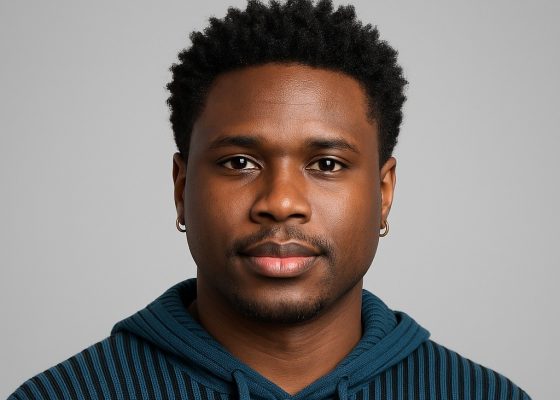

In this in-depth feature, Nigerian content designer Ademola Adepoju discusses how thoughtful use of language in digital finance builds fairness, improves usability, and boosts confidence for everyday users.

Finding Purpose in Content Design: From Everyday Challenges to Industry Impact

Ademola Adepoju’s first steps into content design grew from witnessing the daily frustrations that come with navigating digital platforms. Coming from a marketing background in Nigeria, Adepoju’s pivotal moment came when assisting a loved one with her newly purchased Android phone. The initial excitement faded as confusion set in while setting up banking and utility apps. “That experience stayed with me – the right choice of words and a clear structure can make the difference between access and abandonment,” Adepoju reflects. It was then that inclusion and clarity through language became a lifelong focus.

Shifting fully into UX writing, Adepoju has since overhauled help content—leading to fewer support tickets—and served as lead content designer on a major cross-border remittance app. He also championed the use of content style guides to standardise tone and voice across teams. “Clear, honest language is how you earn the trust of someone new to digital finance, especially when their every naira matters,” he explains.

His graduate work in technical communication at NC State further deepened his approach, giving him new research tools to examine how content, information architecture, and usability intersect—especially for people new to technology, with less formal education, or from older generations. “I want to use real community challenges to drive better messaging, patterns, and results in digital finance,” he notes.

The Early Struggle: Growing a New Profession in Nigeria

Breaking into content design was never easy. The role was relatively unknown in Nigerian tech circles—unlike engineering or product management, there was no playbook or set of best practices. “Part of my job was to explain what content design even meant, and then to prove—one screen at a time—that every word mattered.” He built tone systems and explanatory guides from scratch. With users managing data costs, switching between languages, and using budget smartphones, even a single vague sentence could slow a transaction or stall an important task.

Workplace support made all the difference. According to Adepoju, “I was lucky to be at a company that saw content as essential—not an afterthought. We weren’t just making products; we were earning trust, line by line.” Collaborating with designers, engineers, and researchers who shared this vision, he focused on refining the tiny details that shape a product’s fairness and ease of use.

Seeing real-world impact kept him motivated. “When a simple explanation helped someone avoid panic during a failed payment, or made a tough process feel conquerable, those late nights were worth it. It helps to have a team that values clarity just as much as you do.”

Now, the growth of content design roles in Nigeria is clear evidence that the industry recognises the value of clear, caring language. “It’s rewarding to know I helped lay part of the foundation.”

Understanding User Context: The Nigerian—and African—Reality

Adepoju’s experience in fintech quickly taught him the importance of context. “People approach products with fears, urgent needs, and past disappointments.” He notes that the art of writing for digital finance isn’t about using more words—it’s about giving the right words at the moment they matter: explaining what’s happening, why it matters, and what comes next.

He highlights the importance of transparency: “Trust grows when we say what a choice means today—and down the line.” Clear advance reminders about fees or deadlines turn uncertain first-timers into loyal customers, especially in communities juggling high data costs and limited device memory.

As products evolve, so must their language. Changes in app flows or updates can unsettle users unless clearly explained. “Tooltips, short explanations, and revised copy can help reorient users. But this only works when content designers are part of product research from the beginning—asking questions, listening to how real people describe their challenges.”

Cross-Border Experience: Lessons from Flutterwave

Working at Flutterwave, a leading pan-African fintech, gave Adepoju a front-row seat to the challenges—and opportunities—of designing for a product serving users from Lagos to London, Nairobi to New York.

He explains, “Currency, dates, number formats, and common banking fields aren’t universal. A ‘Routing number’ in the US isn’t the same as a ‘sort code’ in the UK, or a ‘BVN’ in Nigeria. My job was to make every instruction or field label clear in all these markets, preventing second-guessing and failed transactions.”

Beyond practicalities, regulatory demands called for precise, human-centred copy. Strong customer authentication in Europe required explanations to prevent drop-offs. Privacy statements needed to match laws and user expectations, while technical terms like “preauthorisation” or “chargeback” had to be demystified for first-timers or those using finance apps in a second language.

Economic realities also shaped approach: “In Nigeria or Ghana, data costs and phone screen sizes mean every sentence must count.” Inclusion, he says, isn’t about finding a single baseline—it’s about adapting to each context and keeping users informed at the exact moment they need clarity.

The Push for Responsible AI: Making Systems Work for People

Adepoju’s interest in responsible Artificial Intelligence (AI) was fuelled by a recurring pain point: “Too often, people receive automated decisions on screen—credit approval, loan limits, or verification steps—but the product’s language offers little guidance, leaving users feeling confused.” He saw that this lack of explanation could erode trust, even if the technology worked as intended.

Leading an audit of a lending AI system during his graduate studies revealed that while systems could be technically correct, recipients often found outcomes arbitrary or unfair. “If people can’t tell why something happened or what to do next, the experience feels random.”

Now, Adepoju is focused on building transparency into the heart of digital finance: “I want families on tight budgets, new users, and elders to feel included and confident. Writing honest reason statements and providing clear review paths is just as crucial as the underlying AI.”

Inclusive Design: More Than a Buzzword in Nigerian Banking

So, what makes a digital finance platform actually useful? “Inclusive design turns a product from ‘clever’ into ‘trustworthy’,” Adepoju observes. Money decisions come with emotion and risk—especially in Africa, where a missed payment or surprise fee can have a real impact on livelihoods.

Inclusive design means:

- Using everyday language (not banking jargon)

- Making consequences of actions clear before a commitment

- Adapting to local realities—names, addresses, compliance rules, and more

- Guiding users step-by-step rather than assuming prior knowledge

From a business perspective, these practices reduce complaints, ease customer support, and satisfy regulators demanding more transparency. But, Adepoju insists, “Ultimately, it’s about dignity. Everyone sending money or running a business deserves clarity and control.”

Pain Points: Where Apps Fail the Everyday User

Two common problems regularly crop up:

- Confusing Jargon: Terms like ‘preauthorisation’ or ‘settlement window’ are confusing for first-time users or those reading in a second language. Replacing technical terms with plain English and spelling out consequences (e.g., how long a card hold lasts) helps users plan—not panic.

- Vague Decision Wording: Telling users they are “prequalified” for a loan isn’t the same as “approved,” yet many fintechs blur these lines. Clear language, honest timelines, and actionable next steps ensure users know where they stand.

What Works: Lessons from Industry Leaders

Global companies like Wise (formerly TransferWise) lead by example—displaying exchange rates and fees upfront so customers can compare options without nasty surprises. “Transparency, backed by research and clear interface decisions, changes how customers interact with cross-border payments,” Adepoju observes, highlighting industry research from Wise showing how hidden markups can quietly erode user trust.

The Ongoing Battle: Fairness Is a Moving Target

Fairness isn’t a “one-and-done” checklist, especially with fast-evolving algorithms and changing regulations. “Automated systems need constant oversight. If rules squeeze newcomers, small businesses, or people with irregular incomes, the system must be fixed and users clearly told what changed,” he says.

Privacy and consent sit at the heart of this. “If you’re using more data than just a credit bureau score, explain what’s being used, for how long, and how users can turn it off—no mazes or run-arounds.” Whether in Lagos, Abuja, London, or Atlanta, this principle holds.

In certain moments, automation should step aside entirely: “If an algorithm could disrupt a family’s finances, a human agent should be within easy reach—with AI helping to prepare them, not leaving people in the dark about delays or missing documents.”

Looking Ahead: The Strategic Role of UX Writers and Designers

“Our responsibility is broader than just ‘writing copy’. We act as the guardians of user rights inside AI and digital finance products,” says Adepoju. Referencing US policy like the White House’s AI Bill of Rights, he notes, “We must turn legal promises into daily reality: clear explanations, honest statements, easy appeals, and transparency on data and consequences.”

Underserved groups—first-timers, older adults, and those most vulnerable—stand to gain or lose the most. “If products hide details or use insider language, it’s the people on the edge who pay the steepest price. Our strategy should bring protections upstream: lowering reading levels, requiring pre-commitment fee disclosures, and ensuring appeals are obvious and simple.”

Adepoju also stresses the need for ongoing accountability: “Don’t just launch and leave. Track whether users can explain outcomes, find help, and receive fair treatment. If data shows gaps, edit, move, or simplify.”

Building Better Systems: Local Relevance, Lasting Trust

Internal product teams, he argues, should invest in content guardrails—like consistent message sources, shared explanation components, and review gates that catch unclear language before launch. “Community advocates must have real input, and budgets should exist for this—it’s not extra; it’s essential.”

Conclusion: What’s Next for Digital Finance in Nigeria and Beyond?

As the digital finance landscape in Nigeria, Ghana, and across West Africa continues to evolve, the lesson remains clear: inclusive language, proactive explanation, and respect for users’ realities are not luxuries—they are essentials. From Lagos to Nairobi to Atlanta, money management is stressful enough. Clear digital communication isn’t about replacing humans—it’s about making digital tools supportive, fair, and truly accessible.

What’s your own experience navigating digital finance apps in Nigeria or across Africa? Are financial platforms meeting your needs for clarity and fairness, or are there pain points that still frustrate you? Join the conversation below and let us know your thoughts!

Share your tips, opinions, or full stories—whether as a customer, designer, or fintech founder—by emailing story@nowahalazone.com.

For general support or site tips, reach out at support@nowahalazone.com.

Follow us for more news and expert analysis on Facebook, X (Twitter), and Instagram.

Have a story to share or sell? Don’t miss your chance—reach out and let your voice be heard!